Investor analysis

Norwegian salmon companies present deforestation-free opportunities

A recent market mapping by Rainforest Foundation Norway (RFN) identifies one salmon-producing company with an entirely deforestation-free feed supply chain, providing new opportunities for financial institutions that are looking to have deforestation-free portfolios by 2025.

SALMON: Norwegian salmon farm. Photo: Shutterstock

Salmon producer Bremnes Seashore is the world’s first large-scale animal protein producer with a fully deforestation-risk-free feed supply chain.

"This unique position provides new opportunities for investors to reduce climate and nature risks in their portfolios, as well as opportunities for these companies to attract new investors, develop new product labels, increase market access and improve resilience towards changing market demands," says Ida Breckan Claudi, senior supply chain adviser at Rainforest Foundation Norway.

New climate-related opportunities identified under ESG frameworks

Climate change and biodiversity loss present physical, transition and systemic risks to the global economy. The Task Force for Climate-Related Financial Disclosure (TCFD) provides principles and requirements for climate-related disclosures in financial filings and is a global standard for the financial sector to report on climate change risks. The more recent Taskforce for Nature-Related Financial Disclosures (TNFD) follows a similar approach.

Both the TCFD and the TNFD also recognize that efforts to mitigate and adapt to climate change and biodiversity loss may present commercial opportunities for companies. The results of RFN's mapping indicate that the deforestation-free supply chains of several Norwegian salmon companies present such opportunities.

In 2021, the Norwegian aquaculture industry set a new standard for deforestation-free supply chains when they became the first global food producers to move beyond deforestation-free soy volumes in individual supply chains: They set a goal, together with their soy suppliers in Brazil, to become deforestation-free across all operations.

Norwegian salmon thus became the first large-scale animal protein industry with the possibility of producing protein with no exposure to deforestation risk throughout its feed supply chain. Only one – easily avoidable – exposure point to deforestation risk remains: through commercial relationships to feed producer and soy trader Cargill.

MAN-MADE: A man-made fire in the Brazilian Cerrado - a tropical savanna forest. The expansion of soy farming has destroyed large parts of this biodiverse ecosystem. Photo. Victor Moriyama/RFN

Cargill imposes climate-related risks on its customers

The commitment from the Brazilian soy suppliers to the Norwegian salmon sector implies a ban on trading soy grown on land converted after August 2020 and states an important example, adding pressure on industry leaders such as Cargill to follow.

Cargill, a major feed supplier to the Norwegian salmon industry, is a leading global soy trader with high deforestation risk due to its presence and expansion in high-risk areas in Brazil and trade relations with soy suppliers with a deforestation record. It is also a laggard in the global soy industry; Cargill's commitment to detach from soy produced on recently converted land is not ambitious enough. The latter is demonstrated by the agriculture sector’s roadmap to 1.5 degrees, which has been strongly criticized by various stakeholders, including the governments of the UK and the USA, Accountability Framework Initiative, and Consumer Goods Forum.

Unique opportunities: deforestation-free supply chains for Norwegian salmon

In our analysis, we find that Norwegian salmon producers have three exposure points in the feed value chain where they risk contributing to tropical deforestation:

1) through soy volumes (i.e. by purchasing soy produced on recently deforested lands),

2) indirectly through soy suppliers' operations related to other supply chains (i.e. the soy supplier sells deforestation soy to other markets)

3) indirectly through the feed suppliers' operations related to other supply chains (i.e. the feed supplier is involved in deforestation in other parts of its operations)

The specific soy volumes that are used in Norwegian salmon feed have insignificant deforestation risk due to the ProTerra certification that covers all soy streams to Norway. Since the Brazilian soy suppliers have committed to being entirely deforestation-free across operations, the only remaining exposure to deforestation risk is through the high-risk feed supplier Cargill. Cargill has not committed to being deforestation-free across operations, like its soy processing supply chain colleagues have, and thus constitutes the only “non-committed” link in the salmon sector’s feed supply chain.

Among the 10 largest salmon-producing companies in Norway, only one producer has chosen an entirely deforestation-free supply chain. Nine companies have their supply chains “polluted” by feed supplier Cargill.

Norwegian salmon producers: who's deforestation-free?

What we did:

Under the Norwegian Transparency Act, RFN sent requests for information to the ten largest salmon-producing companies in Norway. We asked the companies to disclose their risk assessments regarding human rights violations related to deforestation within their supply chains. We also asked them to disclose their salmon feed suppliers. We thereby analyzed the companies’ supply chain and exposure to deforestation through the three exposure points: soy volumes, soy suppliers, and feed suppliers.

Climate and nature-related risks , opportunities and potential financial impact

The TCFD and TNFD frameworks identify a range of risks that companies face when transitioning to a lower-carbon economy. These include legal risks from land, trade, and due diligence requirements. Risks may also come from a shift in market demand because of corporate sourcing policies. Civil society campaigns and negative media attention could bring reputational risks.

These frameworks also call for disclosure on financial opportunities, and the deforestation-free supply chain of Bremnes Seashore creates economic opportunities. Companies with deforestation-free supply chains are in a unique position to attract new investors through issuing green bonds, developing new product labels, increasing market access and improving resilience towards changing market demands.

In the table below, we identify some of the climate and nature-related opportunities that the deforestation-free salmon-producing companies can explore within the TCFD framework.

Opportunities for deforestation-free salmon producers:

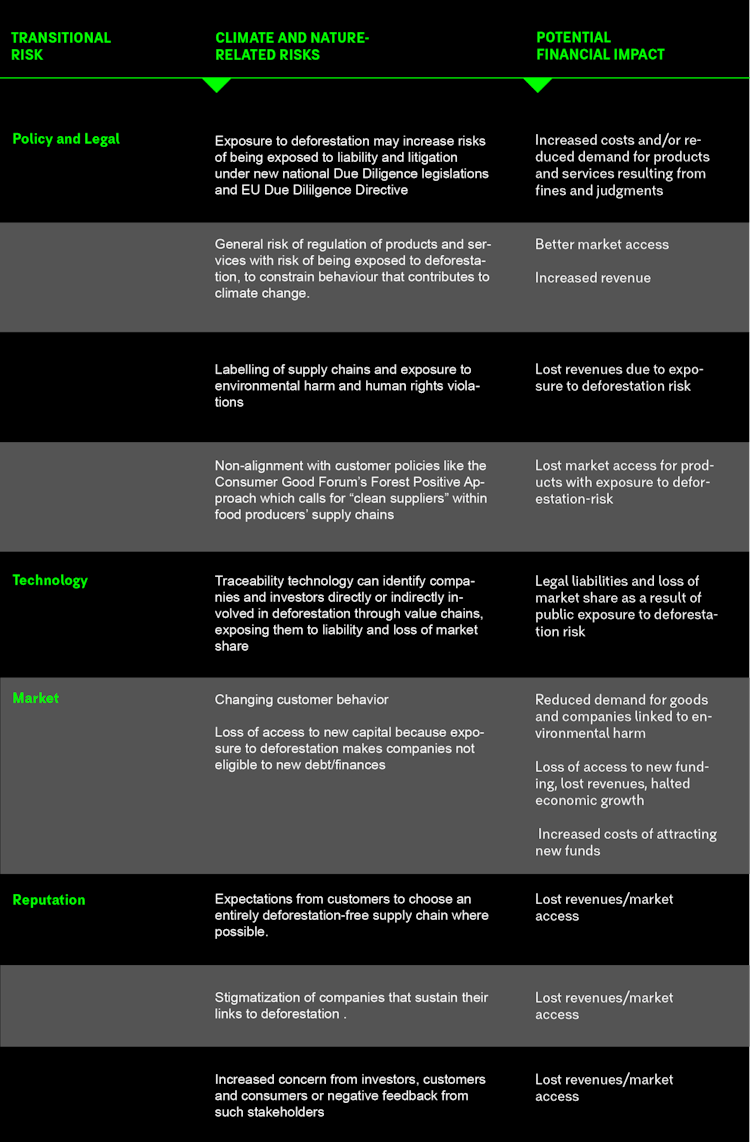

For the salmon producing companies that choose to sustain commercial relations to Cargill and thereby keep their exposure to deforestation-risk, climate and nature-related risks should be disclosed. In the table below, we have identified some of the risks attached to salmon-producing companies with deforestation-risk.

Risks associated with exposure to deforestation

Concluding remarks: choosing deforestation-free supply chains

The TCFD and TNFD frameworks unveil new opportunities that salmon-producing companies with deforestation-free feed supply chains can utilize. New product labels such as “deforestation-free salmon”, increased resilience towards shifting consumer preferences, and shifting legislation and policies make these companies attractive investment objects for investors seeking a deforestation-free investment portfolio.

Salmon-producing companies with no exposure to deforestation risk are better positioned to attract investor interest through for instance green bonds and present a credible investment opportunity for investors who have committed to deforestation-free portfolios by 2025. This suggests that aquaculture companies have the incentives to choose a deforestation-free feed supply chain and that investors should demand disclosure on this exposure point in future TCFD and TNFD reporting.